Why Thabo Mbeki’s illicit financial flows report will do little to stem the problem

By Kolawole Olaniyan

The joint report by the African Union (AU) and the United Nations Economic Commission for Africa (UNECA) on illicit financial flows from Africa has made good headlines. Some have described the report as “a turning-point”; others said its recommendations are “game changing,” and capable of addressing the problem both within Africa and globally.

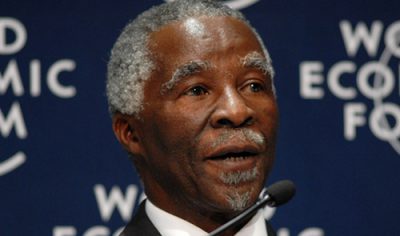

The report, produced by the High Level Panel on Illicit Financial Flows from Africa presided over by former South African president Thabo Mbeki was earlier this month overwhelmingly endorsed by the AU at its 24th Ordinary Session in Addis Ababa.

Mbeki deserves credit for obtaining continent-wide endorsement for the report, and the panel’s recommendation that efforts to combat illicit financial flows be included in the post-2015 Development Agenda is timely, given the expected expiration of the Millennium Development Goals (MDGs) and the steps by the international community to adopt a fresh set of goals (Sustainable Development Goals), expected to be fulfilled over the next 15 years.

The report also contains some useful recommendations on the importance of preventive measures and institutional and capacity building in combating illicit financial flows.

But the panel’s narrowed notion of what constitute ‘illicit financial flows’ (IFFs) combined with a disproportionate focus on the responsibility of big corporations and ‘organized criminals,’ while seemingly minimising the primary responsibility of African governments and leaders, suggests that much more is still required to effectively combat IFFs in Africa.

*Mbeki

I agree with the report’s finding that Africa has to address the wider systems that create IFFs in the first place. Yet, that is just one part of the story. The panel’s scanty treatment of fundamental questions about the nature of IFFs, especially grand corruption, and the impunity of high-ranking government officials that continues to provide the incentives for IFFs to flourish, is a wasted opportunity to rethink how Africa deals with the impunity dimension of IFFs.

While the panel’s definition of IFFs as “money illegally earned, transferred or used” seems robust enough to cover a wide range of illicit activities in equal proportion, its quantification of corruption as amounting to just 5% of the $50 billion lost to IFFs each year is, to say the least, highly debatable.

The panel’s calculation suggests that just around $2.5 billion of the $50 billion of IFFs account for corrupt funds. In contrast, commercial activities account for 65% while other criminal activities take 30%. But the panel’s figure contradicts even the $18 billion that the AU once told us is stolen each year from Africa. The panel should have probed further the responses to its questionnaires that suggest that “corruption is the greatest source of IFFs from the continent.”

Further, the panel’s terms of reference broadly called for it to determine the nature and patterns of illicit financial outflows from Africa but the panel would appear to have perhaps somewhat disingenuously redefined its own terms of reference by choosing to focus on the responsibility of large commercial corporations and organized criminals rather than carefully assessing the responsibility of senior government officials in IFFs. It looks like an effort to push policy down one particular, limited track without a sufficient treatment of the leadership question.

This approach seems politically expedient but it has done a great disservice to the citizens of Africa. The approach also buttresses the impression among African citizens that their governments and ‘leaders’ generally are soft on corruption and soft on the causes of corruption.

The panel’s recommendation that the mandate of the AU advisory board on corruption (established pursuant to article 22 of the AU Convention on Preventing and Combating Corruption) be expanded to cover IFFs ignores the many problems currently besetting the board. Yet, any potential role for the board with respect to IFFs must first resolve some critical issues such as allegations of mismanagement among its leadership, and the fact that its advice are routinely rejected by states. The board also doesn’t have a structure of its own, but is housed within a small department in the Secretariat of the AU Commission in Addis Ababa.

To be sure, grand corruption (a generic term used to describe large-scale embezzlement of public funds, illicit enrichment, bribery, trading in influence and abuse of office, all at the highest level of government) poses a serious threat not only to African citizens and their communities, through for example, lives blighted by poverty, inequality and societies living in fear, but also a regional and global threat which can undermine the democratic and economic basis of societies, and thereby leading to a loss of confidence in the rule of law.

Mis-invoicing of trade transactions and organized crimes are terribly bad but these are just symptoms rather than primary causes of IFFs from Africa. We all see high-ranking government officials with no previous records of success in business, inheritance or a lottery win “wearing Rolex watches, driving Mercedes, owning houses in Paris and London, while sending their children for private education in Switzerland.”

The Ebola crisis in some parts of Africa in fact has exposed the level of grand corruption and its devastating effects on critical institutions of governance. For example, Sierra Leone’s Auditor-General’s recent report showed that the government could not account for nearly a third of the $20m earmarked for fighting Ebola in 2014.

Related to the panel’s narrowed conceptualization of IFFs is the conclusion that “large commercial corporations are by far the biggest culprits of illicit outflows, followed by organized crime.” The panel’s conclusion is based on the assumption that “large corporations possess the means to perpetuate their aggressive and illegal activities,” while “drug dealers have the funds to corrupt many players, including and especially in governments, and even to capture weak states.”

But the panel’s conclusion seems to reinforce the narrative that ‘outsiders’ and ‘other interests’ are primarily responsible for IFFs.

It’s easy for the panel to portray African governments and leaders as so powerless to address the problem. The panel seems to be saying to us: ‘it is fine to let fox guard the chicken house and everything will be normal’!

But as one Yoruba proverb (owe) says “Bi ogiri ko la nu Alangba ko le r’aye wo be” (literally translated as: ‘If the wall does not open up the lizard will not be able to enter’). The key words here are “the wall” and “the lizard.” Without cracks and openings in a wall a lizard can’t inhabit.

It’s true that globalisation has been accompanied by a dramatic increase in illicit financial flows globally. However, much of the illicit financial flows from Africa can’t happen without the direct involvement and complicity of African governments and high-ranking officials or their families and business associates.

Clearly, big corporations and financial institutions are part of the problem but if African governments and leaders are docking responsibility for illicit financial flows, especially grand corruption, why should they expect ‘outsiders’ to play their role and be part of the solution?

The sad reality is that African governments and leaders generally lack the requisite political will to tackle grand corruption. High-ranking corrupt officials also seem to be getting more cunning but anticorruption agencies, the police and security services are not independent or working hard enough to catch them.

It’s going to be very difficult to get the report’s recommendations implemented as long as African governments and leaders continue to dock their primary responsibility, and corrupt leaders are not hit where it most hurts—in their huge stolen public funds that they and their families and friends are sloshing around the world’s onshore and offshore financial centres that depend heavily on de jure or de facto bank secrecy.

If Africa is to truly exercise its sovereignty – both political and economic – it must make getting rid of grand corruption its utmost priority. Sovereignty implies “conducting an independent foreign and internal policy, building of schools, construction of roads, in brief, all types of activity directed towards the welfare of people.” Sovereignty cannot be conceived as a licence for African leaders to commit acts of corruption that imperil human dignity, and then to somehow attempt to shield themselves from responsibility.

By taking grand corruption seriously, African governments and leaders will be reducing the incentives that allow other illicit financial flows to flourish. But if corruption is to be satisfactorily addressed across Africa, it will take a determined push from the ‘woman and man on the street’ and not an elite that becomes ever wealthier as it becomes ever less accountable.

Olaniyan, PhD is the author of ‘Corruption and Human Rights Law in Africa’.